Another Pitfall of Medicare Advantage

NPR Weekend Edition Story explains why enrolling in Medicare Advantage may make it difficult to switch to Traditional Medicare.

NPR Weekend Edition Story explains why enrolling in Medicare Advantage may make it difficult to switch to Traditional Medicare.

In September 2023, Dr. Ed Weisbart gave an informative presentation on Medicare enrollment options and the differences between Medicare and Medicare Advantage.

Dr. Weisbart is the board president of Consumers Council and is also the national board secretary and MO chapter chair of Physicians for a National Health Program, a non-profit non-partisan organization of more than 25,000 physicians and other healthcare advocates in support of a publicly financed, non-profit single-payer national health insurance program that would fully cover medical care for all Americans.

Watch the recorded program here.

https://nicholasinstitute.duke.edu/articles/policy-pandemic-housing-security-policies-reduce-us-covid-19-infection-rates

As the impact of COVID-19 grows in the United States, the lack of vaccines or effective treatment, coupled with anticipated subsequent outbreaks, has made it necessary to adopt unprecedented policy interventions across many aspects of daily life. Now many people are facing financial challenges resulting from these interventions and are struggling to pay housing and utility costs.

In response, many jurisdictions have temporarily halted evictions, suspended foreclosures, and granted relief from utility shutoffs. For example, the federal CARES Act placed a 120-day moratorium on evictions for properties that participate in government programs or that have a federally backed mortgage loan. In addition, many state and local governments issued orders that electric and water utilities continue service even when customers were unable to pay their bills. These protections have been essential for stabilizing people who have lost jobs or experienced income reductions. But they are beginning to expire just as many states are seeing increasing numbers of COVID-19 cases.

Given these evolving circumstances, we decided to look at how housing security interventions have affected infection rates. In our analysis, we evaluate the impacts of:

Our data constitute a panel of daily observations of the confirmed infections in each of 3,141 U.S. counties from March 1 to May 31.4 We calculate the growth rate in infections5 and use county-level fixed effects to adjust for county-level characteristics that do not change over our sample period (i.e., age, race, income, education, housing security, health indicators, environmental indicators, institutional living, transportation use, and percent of the workforce employed by an essential business). We also use fixed effects that vary by week and state to account for changing access to testing. Finally, we include a flexible time trend and account for the duration that each policy has been in effect.

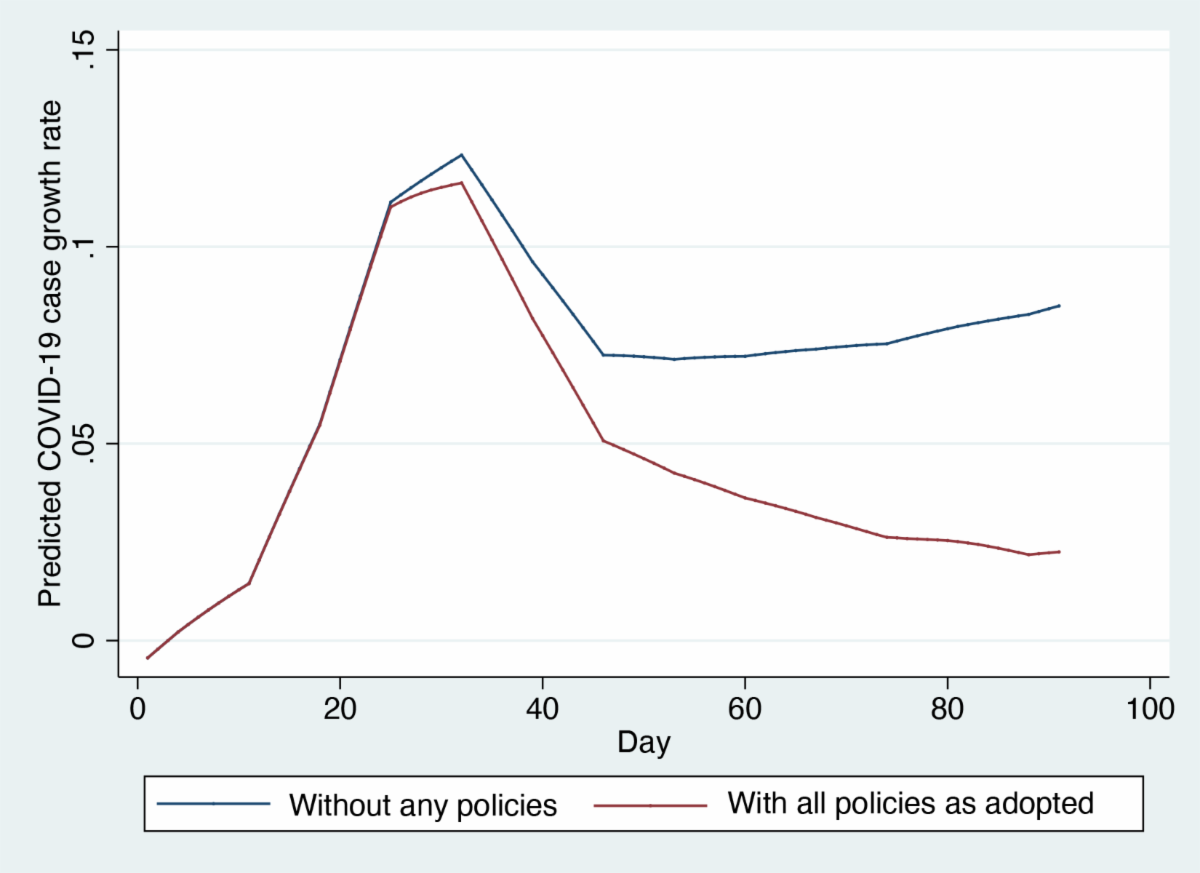

The scenarios presented below illustrate the impacts of these housing security policies on daily coronavirus case growth rates and the degree to which they may matter for managing the pandemic. We found that the CARES Act and eviction, water, and utility moratoria significantly reduced daily infection growth rates as compared to a simulation of the growth rate if no policies were implemented.

Figure 1 illustrates the combined effect of all three policy categories as they were actually implemented in the U.S., or the average growth rate across all counties at each point in time, combined with a simulated growth rate showing the result if none of the policies had been adopted. If we assume no policies had been adopted, the predicted average growth rate per day is 7.2%, while the actual growth rate is 4.7%. Thus, at the end of the sample on day 91, the predicted growth rate of an average county where no policies were in effect is 8.7% whereas that of an average county in reality is 2.3%, suggesting that the set of policies has reduced the growth rate by 6.4%.

Figure 2 breaks down the role of eviction and utility moratoria in those reductions. The evictions moratoria and water and utility moratoria show the average daily growth rate if every county in the U.S. had implemented these policies throughout the duration of the sample period. These are again compared to a predicted average daily growth rate for no policies of 7.2%. If a state or local eviction moratorium were in place, the average growth rate per day decreases to 2.7%; if the water and utility shutoff moratoria are in place, the average growth rate per day decreases to 4.6%. This shows that the eviction moratoria reduce the average growth rate by 4.5% and water and utility shutoff moratoria reduce the average growth rate by 2.6%.

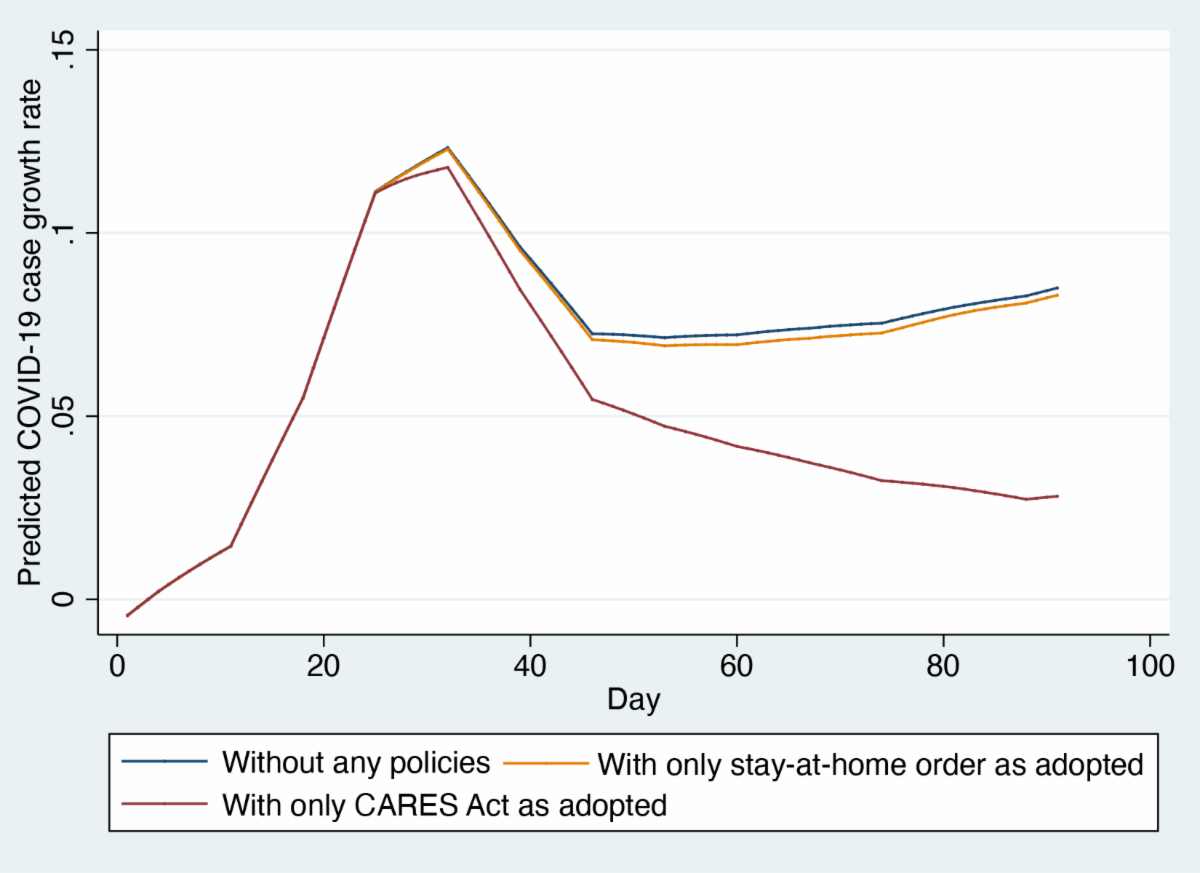

In Figure 3, we turn to the effects of federal housing policy through the CARES Act and stay-at-home orders, relative to a “no policy” daily growth rate. On average, while the CARES Act is in place, the predicted growth rate per day is 5.0%, reducing the average growth rate by 2.2%. If a stay-at-home order is in place, the predicted growth rate per day is 7.0%, which results in a 0.2% reduction in the average log growth rate.

Our analysis shows that eviction, electricity, and water utility moratoria have played an important role in containing the COVID-19 pandemic and one that should be carefully considered as these moratoria are lifted. We are engaged in continuing to analyze these policies and their effects at mitigating the spread of COVID-19. Simultaneously, these policies also have impacts on landlords and utilities, the implications of which are not well understood either. A deeper understanding of how these moratoria affect both the spread of COVID-19 and those who supply housing, water, and electricity will better inform policy decisions during this public health crisis.

Kay Jowers is a senior policy associate with the State Policy Program at Duke University’s Nicholas Institute for Environmental Policy Solutions. Christopher Timmins is a professor in the Department of Economics at Duke University. Nrupen Bhavsar is an assistant professor in medicine at Duke University School of Medicine.

To continue the conversation on this week’s topic, here are a few questions for further consideration and study:

Jefferson City — Believe it or not, generic medicines can be less expensive than co-pays, making them cheaper to buy outright than with insurance – but your pharmacist may be banned from telling you that. The cost difference doesn’t go to the pharmacist, it doesn’t go to the drug manufacturer, it goes to the middleman: the drug benefit manager. That payback is called a clawback.

Clawbacks can range from $2 to $30 a prescription, boosting profits while unfairly charging consumers.

Patients shouldn’t have to pay more than a drug costs. Many states are moving to block the “gag clauses” that prohibit pharmacists from telling customers that they could save money by paying cash rather than using their health insurance. Missouri should be the next state to join that list.

HB 1542 sponsored by Representative Lynn Morris, prohibits clawbacks and eliminates gag clauses in Missouri. This bill will allow your pharmacist to tell you the least expensive way to pay for your drugs and will save Missourians money.

“With the costs of drugs skyrocketing in this country, consumers should be enabled to make informed decisions.” says Cara Spencer of the Consumers Council of Missouri. “Policies that prohibit a pharmacist from communicating pricing information to a patient should have no place in our state. HB 1542 deserves to be heard.”

Please contact our state leadership and let them know that the cost of drugs is important to Missouri consumers and we shouldn’t have to pay more unknowingly.

MO Speaker of the House Todd Richardson: 573-751-4039, Todd.Richardson@house.mo.gov.

Majority Floor Leader Rob Vescovo: 573-751-3607, Rob.Vescovo@house.mo.gov

Chlora Lindley-Myers

Director, Missouri Department of Insurance

Truman State Office Building, Room 530

Jefferson City, MO 65102

Director Lindley-Meyers:

Attached are the complete comments from Consumers Council of Missouri on proposed individual rate increases for 2018. We commend the Department along with the carriers for ensuring that all counties in MO have ACA coverage, leaving no Missouri consumer without any options.

Three companies will be offering insurance on the exchange in Missouri in 2018: Cigna Health and Life Insurance Company (Cigna), Healthy Alliance Life Insurance Company, aka Anthem (HAL) and Celtic Insurance Company, a subsidiary of Centene (Celtic). One of these companies, Celtic, is new to the Missouri marketplace. The other two have filed for significant increases over last year’s premiums.

Cigna’s proposed rate increases will affect approximately 84,000 Missourians and proposed increases are significant varying from 17% to 73% with an average increase of 42%. Healthy Alliance has proposed a rate increase which will impact approximately 116,000 people in Missouri. Proposed increases vary between 30% and 47%, with an average of 41.7%. Index rates show Celtic with the lowest at $354.48, Cigna with $476.44 and Healthy Alliance with the highest at $841.24.

We took great care to analyze the data submitted by each insurer as well some of the new Department of Health and Human Service’s (HHS) rules, particularly the Market Stabilization Rule (MSR) and how new regulations have been projected to impact the cost of providing coverage.

Notably neither Cigna nor HAL took into account a number of regulatory changes included in the MSR which the Department of Health and Human Services adopted in an effort to improve the risk pool and promote stability in the individual market. Specifically omitted from justifications were the following aspects of the MSR which should have contributed to a reduction in premiums:

* Guaranteed Availability of Coverage which requires each issuer to provide coverage despite past-due premiums, but allowing premiums paid for new coverage to be paid towards past-due premiums, a change applauded by many in the industry including both Anthem and Cigna.

* Shortening of Open Enrollment periods which should reduce morbidity by reducing adverse selection by those who learn they will need medical services in late December and January, a change applauded by insurers.

* Special Enrollment Periods – ensuring that people who lose health insurance during the year due to in-voluntary non-health related events have the opportunity to enroll in new coverage, changed by HHS as requested by the insurance industry to allow for event verification and adopting several new restrictions. A change supported by insurers including Anthem and Cigna and resulting in an estimated premium reduction of 1.5% by HHS.

* Levels of Coverage – allowing flexibility to metal level plans, a change applauded by the industry, specifically Anthem and Centene.

In addition to the omission of MSR changes which should result in premium reduction, we note some concerning aspects of the individual filings, notably HAL is assuming a trend of 13.3% which is three times higher than the 4.3% countrywide trend Milliman calculated for 2017 in its Milliman Medical Index. This appears to be unrealistically high and is a significant driver of the rate increase.

The Cigna filing completely redacts of the trend applied, an unnecessary redaction which undermines the public’s ability to weigh in on the filing at all. Secondly, this filing includes an implication that Cigna is a passive price-taker without any bargaining power to drive down cost of care. And lastly, includes a trend factor assumption of 12.5% for prescription drugs, whereas Milliman calculates only 8%.

In summary, the filings include several unreasonable assumptions as well as a redaction of much of the data needed to properly analyze the findings. Therefore, Consumers Council of Missouri urges the Department to exercise its authority under Mo. Rev. Stat. § 376.465.10(4) and deem both Cigna and Healthy Alliance rates unreasonable absent further justification.

We appreciate the opportunity to weigh in directly to the Missouri Department of Insurance for the first time on proposed rate increases and respectfully ask that the Department consider these comments with review of the proposed increases, which are significant and will affect many Missourian’s ability to afford health insurance.

Sincerely,

Cara Spencer, Executive Director

Consumers Council of Missouri

Consumers Council of Missouri has completed a formal review of proposed 2018 health insurance rates in the state of Missouri. This marks the first year the Missouri Department of Insurance has the authority to review rates and CCM is calling for the Department to deem each of the rates hikes “unreasonable.”

Three companies will be offering insurance on the exchange in Missouri in 2018: Cigna, Healthy Alliance (Anthem) and Celtic (Centene, new to the MO exchange). Proposed rate increases are estimated to affect hundreds of thousands of Missourians and increases vary from 17% to 73% for individual plans. This will have a significant impact on consumers ability to afford insurance throughout the state.

In summary, the filings include several unreasonable assumptions as well as a redaction of much of the data needed to properly analyze the findings. Therefore, Consumers Council of Missouri urges the Department to exercise its authority under Mo. Rev. Stat. § 376.465.10(4) and deem rates proposed by both Cigna and Healthy Alliance unreasonable absent further justification.

CCM’s full report of Cigna’s rate filing can be downloaded here and our full report for Healthy Alliance can be downloaded here and with our letter to the Department which summarizes both may be viewed here.

Join us in commenting to the Department of insurance. Instructions for filing comments can be found here and a sample letter to the Department can be downloaded here.

Consumers Council of Missouri has completed a complete review of proposed 2018 health insurance rates in the state of Missouri.

Proposed rates for the 2018 Missouri health insurance exchange were released on Friday by the Missouri Department of Insurance.

While the Department and our state’s carriers both deserve credit for ensuring that all counties in MO have ACA coverage, this comes at significant cost. Requested increases average between 35 and 42% according to a review by the Department and as reported here.

What makes these increases even worse is that they come with compromised transparency to the general public, allowing carriers to hide critical elements they are relying on to justify significant increases. While many states allow no redactions at all, Missouri insurance companies routinely omit reasons for increases from public documents. You can read CCM’s request and legal argument for more transparency here.

Join Consumers Council of Missouri as we weigh in on these proposed rates. By federal law, the public has 30 days to comment. Contact us if you’d like guidance on submitting comment.

Under Governor Greitens, the state has launched an initiative to increase transparency and within that framework, Consumers Council of Missouri submits a formal argument that the Department’s regulation 20 CSR § 10-2.400, on the redaction of trade secrets, should be updated to reflect what is required by law and that nothing that isn’t a trade secret should be withheld from the public.

Insurance companies routinely designate a substantial amount of information in their rate filings as confidential which makes it virtually impossible for consumers to weigh in during federally mandated public comment periods. If we really want to increase transparency as a state, we should add transparency, we should start with the rising costs of health care.