Chlora Lindley-Myers

Director, Missouri Department of Insurance

Truman State Office Building, Room 530

Jefferson City, MO 65102

Director Lindley-Meyers:

Attached are the complete comments from Consumers Council of Missouri on proposed individual rate increases for 2018. We commend the Department along with the carriers for ensuring that all counties in MO have ACA coverage, leaving no Missouri consumer without any options.

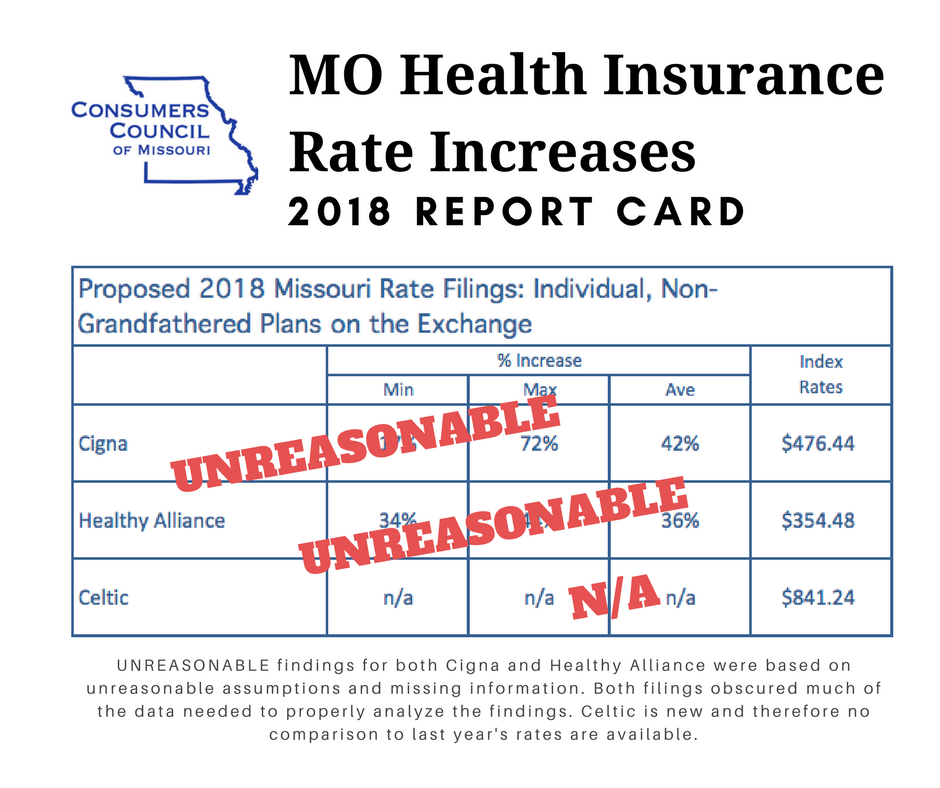

Three companies will be offering insurance on the exchange in Missouri in 2018: Cigna Health and Life Insurance Company (Cigna), Healthy Alliance Life Insurance Company, aka Anthem (HAL) and Celtic Insurance Company, a subsidiary of Centene (Celtic). One of these companies, Celtic, is new to the Missouri marketplace. The other two have filed for significant increases over last year’s premiums.

Cigna’s proposed rate increases will affect approximately 84,000 Missourians and proposed increases are significant varying from 17% to 73% with an average increase of 42%. Healthy Alliance has proposed a rate increase which will impact approximately 116,000 people in Missouri. Proposed increases vary between 30% and 47%, with an average of 41.7%. Index rates show Celtic with the lowest at $354.48, Cigna with $476.44 and Healthy Alliance with the highest at $841.24.

We took great care to analyze the data submitted by each insurer as well some of the new Department of Health and Human Service’s (HHS) rules, particularly the Market Stabilization Rule (MSR) and how new regulations have been projected to impact the cost of providing coverage.

Notably neither Cigna nor HAL took into account a number of regulatory changes included in the MSR which the Department of Health and Human Services adopted in an effort to improve the risk pool and promote stability in the individual market. Specifically omitted from justifications were the following aspects of the MSR which should have contributed to a reduction in premiums:

* Guaranteed Availability of Coverage which requires each issuer to provide coverage despite past-due premiums, but allowing premiums paid for new coverage to be paid towards past-due premiums, a change applauded by many in the industry including both Anthem and Cigna.

* Shortening of Open Enrollment periods which should reduce morbidity by reducing adverse selection by those who learn they will need medical services in late December and January, a change applauded by insurers.

* Special Enrollment Periods – ensuring that people who lose health insurance during the year due to in-voluntary non-health related events have the opportunity to enroll in new coverage, changed by HHS as requested by the insurance industry to allow for event verification and adopting several new restrictions. A change supported by insurers including Anthem and Cigna and resulting in an estimated premium reduction of 1.5% by HHS.

* Levels of Coverage – allowing flexibility to metal level plans, a change applauded by the industry, specifically Anthem and Centene.

In addition to the omission of MSR changes which should result in premium reduction, we note some concerning aspects of the individual filings, notably HAL is assuming a trend of 13.3% which is three times higher than the 4.3% countrywide trend Milliman calculated for 2017 in its Milliman Medical Index. This appears to be unrealistically high and is a significant driver of the rate increase.

The Cigna filing completely redacts of the trend applied, an unnecessary redaction which undermines the public’s ability to weigh in on the filing at all. Secondly, this filing includes an implication that Cigna is a passive price-taker without any bargaining power to drive down cost of care. And lastly, includes a trend factor assumption of 12.5% for prescription drugs, whereas Milliman calculates only 8%.

In summary, the filings include several unreasonable assumptions as well as a redaction of much of the data needed to properly analyze the findings. Therefore, Consumers Council of Missouri urges the Department to exercise its authority under Mo. Rev. Stat. § 376.465.10(4) and deem both Cigna and Healthy Alliance rates unreasonable absent further justification.

We appreciate the opportunity to weigh in directly to the Missouri Department of Insurance for the first time on proposed rate increases and respectfully ask that the Department consider these comments with review of the proposed increases, which are significant and will affect many Missourian’s ability to afford health insurance.

Sincerely,

Cara Spencer, Executive Director

Consumers Council of Missouri